Asian stocks surge on tech boost; yen extends gains to cap wild week

Asian stocks rallied on Friday after Apple’s record $110 billion share buyback plan lifted the tech sector, while the yen put more distance from recent 34-year lows to cap a tumultuous week that saw suspected interventions from Tokyo.

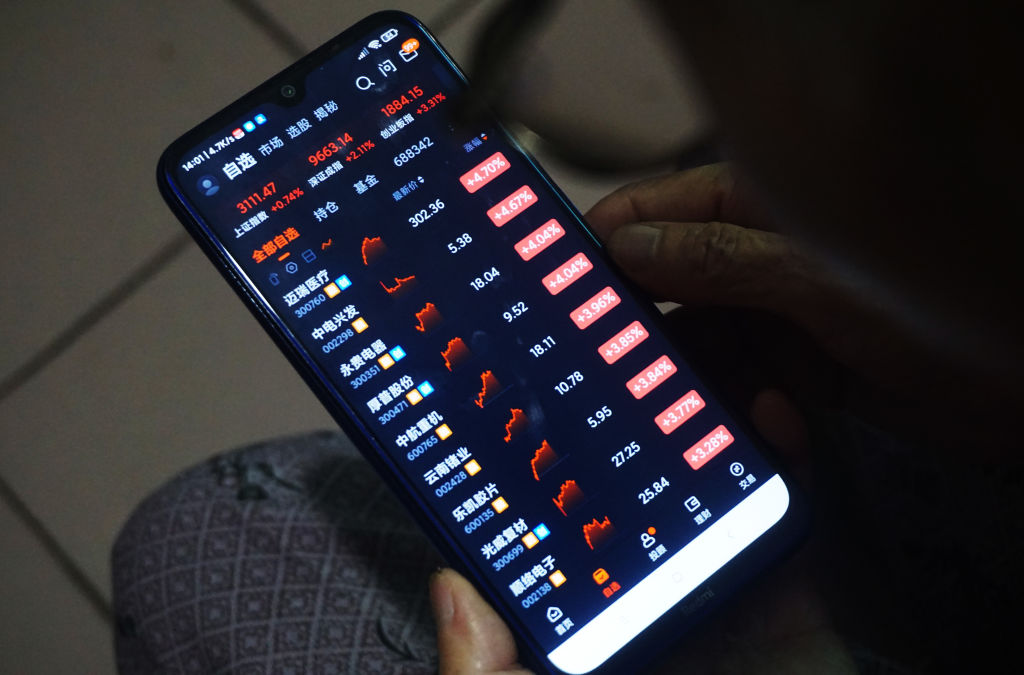

With markets in Japan and mainland China closed on Friday, regional trading activity is likely to be subdued as traders look ahead to the U.S. nonfarm payrolls data later in the day.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 1.5% and was set for a second straight week of gains. Hong Kong’s Hang Seng Index spiked 2% higher, on course for a 5% gain for the week.

The yen strengthened 0.55% to 152.80 per dollar in early trading on Friday, having started the week by touching a 34-year low of 160.245 per dollar on Monday.

In between, traders suspect the authorities stepped in on at least two days this week and data from the BOJ suggests Japanese officials may have spent roughly $60 billion to defend the beleaguered yen, leaving trading desks across the globe on high alert foe further moves by Tokyo.

A series of Japanese public holidays as well as Monday’s holiday in the UK – the world’s biggest FX trading centre – could present a possible window for further intervention by Tokyo. Japanese markets are also closed on Monday.

The yen has weakened for over a decade, largely due to low Japanese interest rates drawing funds out of the country towards higher yielding assets in other large economies including the United States. Despite the sizable bounce in the yen this week, it is still down 8% against the dollar this year.

While there has been two bouts of suspected MOF interventions, another $20 billion of yen buying on Friday would really scare off the yen shorts and get dollar/yen below 150, Chris Weston, head of research at Pepperstone, said in a note.

“Good things come in three’s, and while another bout of intervention seems unlikely, the MOF/BOJ could turn momentum trader and shake things up one last time ahead of nonfarm payrolls.”

The dollar which measures the U.S. currency against six peers, was last at 105.25. The index is set to clock a 0.7% decline for the week, its worst weekly performance since early March.

The Federal Reserve this week left rates unchanged and signalled that its next policy move will be to lower its rates, though chair Jerome Powell noted that recent strong inflation readings have suggested that the first of these cuts could be a long time in coming.

“The Federal Reserve has clearly had its confidence shaken by the recent string of disappointing inflation releases,” said Susan Hill, senior portfolio manager at Federated Hermes.

While the bar for moving back to a tightening bias is quite high, it seems likely that the current 5.25%-5.50% Fed Funds target range will be unchanged for the next several months, Hill said.

U.S. stocks ended higher on Thursday, with tech heavy Nasdaq advancing 1.5% buoyed by chip stocks.

In after-market hours Apple reported quarterly results and forecast that beat modest expectations and unveiled a record share buyback program, sending its stock up almost 7% in extended trade.

U.S. economic data on Thursday also showed the labour market remains tight, ahead of key government payrolls data due later on Friday. Economists polled by Reuters forecast 243,000 jobs, with estimates ranging from 150,000 to 280,000.

In commodities, U.S. crude rose 0.39% to $79.26 per barrel and Brent LCOc1 was at $83.98, up 0.37% on the day.

Spot gold was last $2,304.16 an ounce and were set for second straight weekly decline.

(Reuters)